Table of Content

Amy files her federal income tax return on a calendar year basis. On April 20, she began using 100 square feet of her home for a qualified business use. On August 5, she expanded the area of her qualified use to 330 square feet.

Although the new mortgage loan was for Bill's continued ownership of his main home, it wasn't for the purchase or substantial improvement of that home. He can deduct two points ($2,000) ratably over the life of the loan. He deducts $67 [($2,000 ÷ 180 months) × 6 payments] of the points in 2022. The other point ($1,000) was a fee for services and isn't deductible. The points weren't paid in place of amounts that are ordinarily stated separately on the settlement statement, such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes. This means you report income in the year you receive it and deduct expenses in the year you pay them.

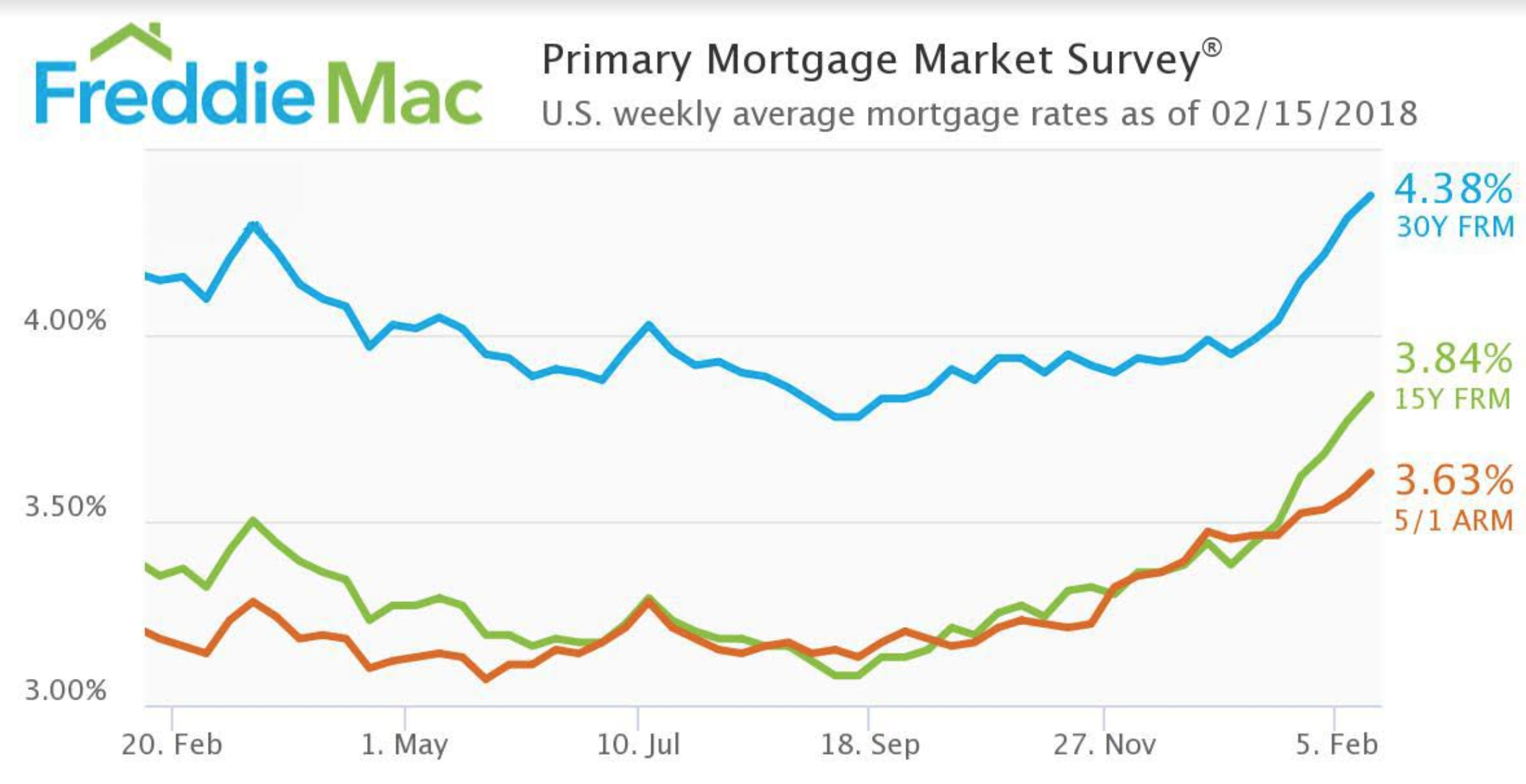

How the Mortgage Interest Tax Deduction is Changing in 2018

The patronage dividend is a partial refund to the cooperative housing corporation of mortgage interest if paid in a prior year. Generally, if you're a tenant-stockholder, you can deduct payments you make for your share of the interest paid or incurred by the cooperative. The interest must be on a debt to buy, build, change, improve, or maintain the cooperative's housing, or on a debt to buy the land. Deduct home mortgage interest that wasn't reported to you on Form 1098 on Schedule A , line 8b. If you paid home mortgage interest to the person from whom you bought your home, show that person's name, address, and taxpayer identification number on the dotted lines next to line 8b.

That’s because the 2017 Tax Cuts and Jobs Act limited the deduction to the interest on the first $750,000 of a mortgage. The mortgage interest deduction allows you to reduce your taxable income by the amount of money you’ve paid in mortgage interest during the year. So if you have a mortgage, keep good records — the interest you’re paying on your home loan could help cut your tax bill. The biggest change that will impact homeowners is the mortgage interest tax deduction. Previously, homeowners could deduct interest on up to $1 million of mortgage debt from their income.

The Largest Deductions Taken by High-Income Households

This is true even if the new mortgage is secured by your main home. The points were figured as a percentage of the principal amount of the mortgage. If you make annual or periodic rental payments on a redeemable ground rent, you can deduct them as mortgage interest. You can treat a home you own under a time-sharing plan as a qualified home if it meets all the requirements. A time-sharing plan is an arrangement between two or more people that limits each person's interest in the home or right to use it to a certain part of the year.

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Look in your mailbox for Form 1098.Your mortgage lender sends you a Form 1098 in January or early February. It details how much you paid in mortgage interest and points during the tax year. Your lender sends a copy of that 1098 to the IRS, which will try to match it up to what you report on your tax return. If you use the money to buy a car, pay down credit card debt, or pay for something else not home-related, the interest isn’t deductible .

Permanent Build Back Better Act Would Likely Require Large Tax Increases on the Middle Class

You use part of your home exclusively and regularly to read financial periodicals and reports, clip bond coupons, and carry out similar activities related to your own investments. So, your activities are not part of a trade or business and you cannot take a deduction for the business use of your home. Your home is the only fixed location of your business of selling mechanics' tools at retail. You regularly use half of your basement for storage of inventory and product samples.

Explain how to divide the excess interest among the activities for which the mortgage proceeds were used. In the year paid, you can deduct $1,750 ($750 of the amount you were charged plus the $1,000 paid by the seller). You must reduce the basis of your home by the $1,000 paid by the seller.

She conducts administrative or management activities there and she has no other fixed location where she conducts substantial administrative or management activities. The fact that she conducts some administrative or management activities in her hotel room does not disqualify her home office from being her principal place of business. She meets all the qualifications, including principal place of business, so she can deduct expenses for the business use of her home. The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. The term “home” includes a house, apartment, condominium, mobile home, boat, or similar property which provides basic living accommodations. It also includes structures on the property, such as an unattached garage, studio, barn, or greenhouse.

If you have a second home that you don’t hold out for rent or resale to others at any time during the year, you can treat it as a qualified home. Is recorded or is otherwise perfected under any state or local law that applies. Both you and the lender must intend that the loan be repaid. You can’t deduct home mortgage interest unless the following conditions are met. Section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics by using the search feature or viewing the categories listed. 936, such as legislation enacted after it was published, go to IRS.gov/Pub936.

The 2018 standard deduction for heads of households is $18,000 (versus $9,350 for 2017), and the 2018 standard deduction for singles and those who use married filing separate status is $12,000 (versus $6,350 for 2017). Policymakers could also reduce distortions among different types of capital investments by reducing the tax burden on other types of capital assets. For example, the CBO has laid out three sequential steps that could transition the U.S. tax code away from taxing capital income. The first would be to remove various restrictions placed on individual retirement accounts, which would lower effective tax rates on capital income at the individual level. The second would be to allow full expensing of capital acquisitions, which would lower effective rates for businesses.

Traditionally, roughly 30% of taxpayers have itemized deductions each year. In 2018, early forecasts predict that this will drop to just 5%. In other words, 25% of the U.S. population will no longer be able to itemize deductions, and therefore won’t be able to use the mortgage interest deduction in 2018. Tables and figuresDeductible home mortgage interestFully deductible, determination of , Fully deductible interest.How to figure , Table 1. Don determines that the proceeds of mortgage A are allocable to personal expenses for the entire year. The proceeds of mortgage B are allocable to his business for the entire year.

This proportion is significantly lower than what the proportion would have been in 2019 under pre-TCJA law, which would have been just over 31 percent. This is because the TCJA expanded the standard deduction from $6,500 in 2017 to $12,000 in 2018 ($13,000 to $24,000 for married filing jointly). Now, fewer taxpayers itemize overall, and the proportion of taxpayers itemizing increases with income. Donna files her federal income tax return on a calendar year basis.

The impact the income tax has on housing can be summarized by measuring the effective marginal tax rate on housing. An EMTR is a summary measure, expressed as a single percentage, that estimates how a tax system reduces the return to, and thus the incentive to invest in, a new asset, like a house. The IRS doesn’t initiate contact with taxpayers by email, text messages , telephone calls, or social media channels to request or verify personal or financial information. Tax-related identity theft happens when someone steals your personal information to commit tax fraud. Your taxes can be affected if your SSN is used to file a fraudulent return or to claim a refund or credit. If you have questions about a tax issue; need help preparing your tax return; or want to download free publications, forms, or instructions, go to IRS.gov to find resources that can help you right away.

No comments:

Post a Comment