Table of Content

Since lenders pay taxes on the mortgage interest they receive, deductibility of mortgage interest is the appropriate treatment of interest for homeowners who finance with debt. More generally, the tax code treats housing more neutrally than how it treats investment in other assets. Though owner-occupied housing is the beneficiary of several prominent tax expenditures, these tax expenditures mean that the treatment of owner-occupied housing is more consistent with how it would be treated in a consumption tax. If you make payments to a financial institution, or to a person whose business is making loans, you should get Form 1098 or a similar statement from the lender. This form will show the amount of interest to enter on line 13. Also, include on this line any other interest payments made on debts secured by a qualified home for which you didn't receive a Form 1098.

After the TCJA, home equity loans are now included within the mortgage’s principal, and interest is only deductible if used to build or improve a qualifying residence. In 2022, Bill refinanced that mortgage with a 15-year $100,000 mortgage loan. Two points ($2,000) were for prepaid interest, and one point ($1,000) was charged for services, in place of amounts that are ordinarily stated separately on the settlement statement. Bill paid the points out of his private funds, rather than out of the proceeds of the new loan.

How Does LendingTree Get Paid?

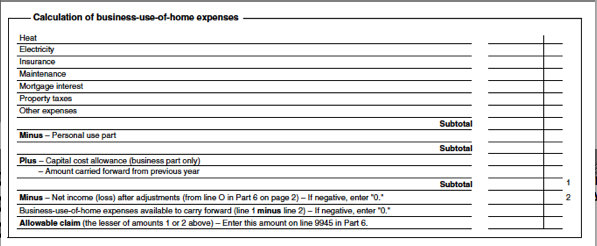

Since the room was available for business use during regular operating hours each business day and was used regularly in the business, it is considered used for daycare throughout each business day. The basement and room are 60% of the total area of her home. In figuring her expenses, 34.25% of any direct expenses for the basement and room are deductible.

The costs of improvements made after you begin using your home for business are depreciated separately. Multiply the cost of the improvement by the business-use percentage and depreciate the result over the recovery period that would apply to your home if you began using it for business at the same time as the improvement. For improvements made this year, the recovery period is 39 years. Other expenses are deductible only if you use your home for business.

Standard Deductions

Bill deducts 25% ($25,000 ÷ $100,000) of the points ($2,000) in 2022. Payments on a nonredeemable ground rent aren't mortgage interest. You can deduct them as rent if they are a business expense or if they are for rental property. If you qualify for mortgage assistance payments for lower-income families under section 235 of the National Housing Act, part or all of the interest on your mortgage may be paid for you. Through April 30, they made home mortgage interest payments of $1,220. The settlement sheet for the sale of the home showed $50 interest for the 6-day period in May up to, but not including, the date of sale.

Examples of business expenses that are unrelated to the use of the home are advertising, wages, supplies, dues, and depreciation for equipment. Use lines 1–7 of Form 8829, or lines 1–3 on the Worksheet To Figure the Deduction for Business Use of Your Home to figure your business percentage. If you deducted more depreciation than you should have, decrease your basis by the amount you should have deducted, plus the part of the excess depreciation you deducted that actually decreased your tax liability for any year. Before you figure your depreciation deduction, you need to know the following information.

What is the mortgage interest deduction?

However, you're not required to use this special method to figure your deduction for mortgage interest and real estate taxes on your main home. Where To Deduct Your Interest Expense Worksheet to figure , Table 1. Acquisition Indebtednessis debt incurred in acquiring, constructing, or substantially improving a qualified residence of the taxpayer, and is secured by the residence. The maximum allowable principal balance for calculating the interest deduction on acquisition indebtedness is $1,000,000 ($500,000 for married filing separately). A personal loan used for major improvements is not considered acquisition indebtedness unless it is secured by the home.

If you use your home in a trade or business and you file Schedule C , you will use the Simplified Method Worksheet in your Instructions for Schedule C to figure your deduction. Your deduction for the qualified business use of a home is the sum of each amount you figure for a separate qualified business use of your home. To figure your deduction for the business use of a home using the simplified method, you will need to know the following information for each qualified business use of the home. If your gross income from the business use of your home is less than your total business expenses, your deduction for certain expenses for the business use of your home is limited. Decrease the basis of your property by the depreciation you deducted, or could have deducted, on your tax returns under the method of depreciation you properly selected.

Home Mortgage Interest Deduction by the Numbers

On line 33, enter the total of the casualty losses shown on lines 10 and 31. Enter the amount from line 33 on line 27 of Form 4684, Section B. Attach a statement to your tax return showing how you calculated the deductible loss and enter "See attached statement" above line 27 of Form 4684. See the Instructions for Form 4684 for more information on completing that form. The personal portion of deductible mortgage interest you included in column of line 6. For example, if your business percentage on line 3 is 30%, 70% of the amount you included in column of line 6 is deductible as an itemized deduction on Schedule A.

The expenses for the storage space are deductible even though you do not use this part of your basement exclusively for business. If you use part of your home for storage of inventory or product samples, you can deduct expenses for the business use of your home without meeting the exclusive use test. There are many tax breaks you can get as a homeowner, including tax deductions, which help you reduce your taxable income each year. Your mortgage lender will send you a form, called Form 1098, that details the amount of mortgage interest you paid over the year. If you paid less than $600 in interest, your lender isn’t required to send you this document.

It’s more user-friendly for taxpayers, including retirees and self-employed individuals. Do not allocate more square feet to this qualified business use than was actually used during the year. Do not allocate any amount on line 3c to this qualified business use that you allocated to another qualified business use. If you used at least 300 square feet for daycare regularly and exclusively during the year, then you do not need to complete this worksheet. This worksheet is only needed if you did not use the allowable area exclusively for daycare..

After the passage of TRA86 the deductibility of personal interest was reduced to 65% and home mortgage interest remained. For the purposes of the mortgage interest deduction, a "qualified residence" means the taxpayer's primary residence or second home . When you figure your itemized deduction for state and local taxes on Schedule A, only include the personal portion of your real estate taxes on line 5b of Schedule A.

Homeowners are required to report their home mortgage loan interest on Schedule A of Form 1040. Publication 936 discusses the rules for deducting home mortgage interest. You have to use the money from the home equity loan to buy, build or “substantially improve” your home. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here's a list of our partners.

Home acquisition debt is a mortgage you took out after October 13, 1987, to buy, build, or substantially improve a qualified home . Receives at least 80% of its gross income for the year in which the mortgage interest is paid or incurred from tenant-stockholders. For this purpose, gross income is all income received during the entire year, including amounts received before the corporation changed to cooperative ownership. When you took out a $100,000 mortgage loan to buy your home in December, you were charged one point ($1,000). You meet all the tests for deducting points in the year paid, except the only funds you provided were a $750 down payment. Of the $1,000 charged for points, you can deduct $750 in the year paid.

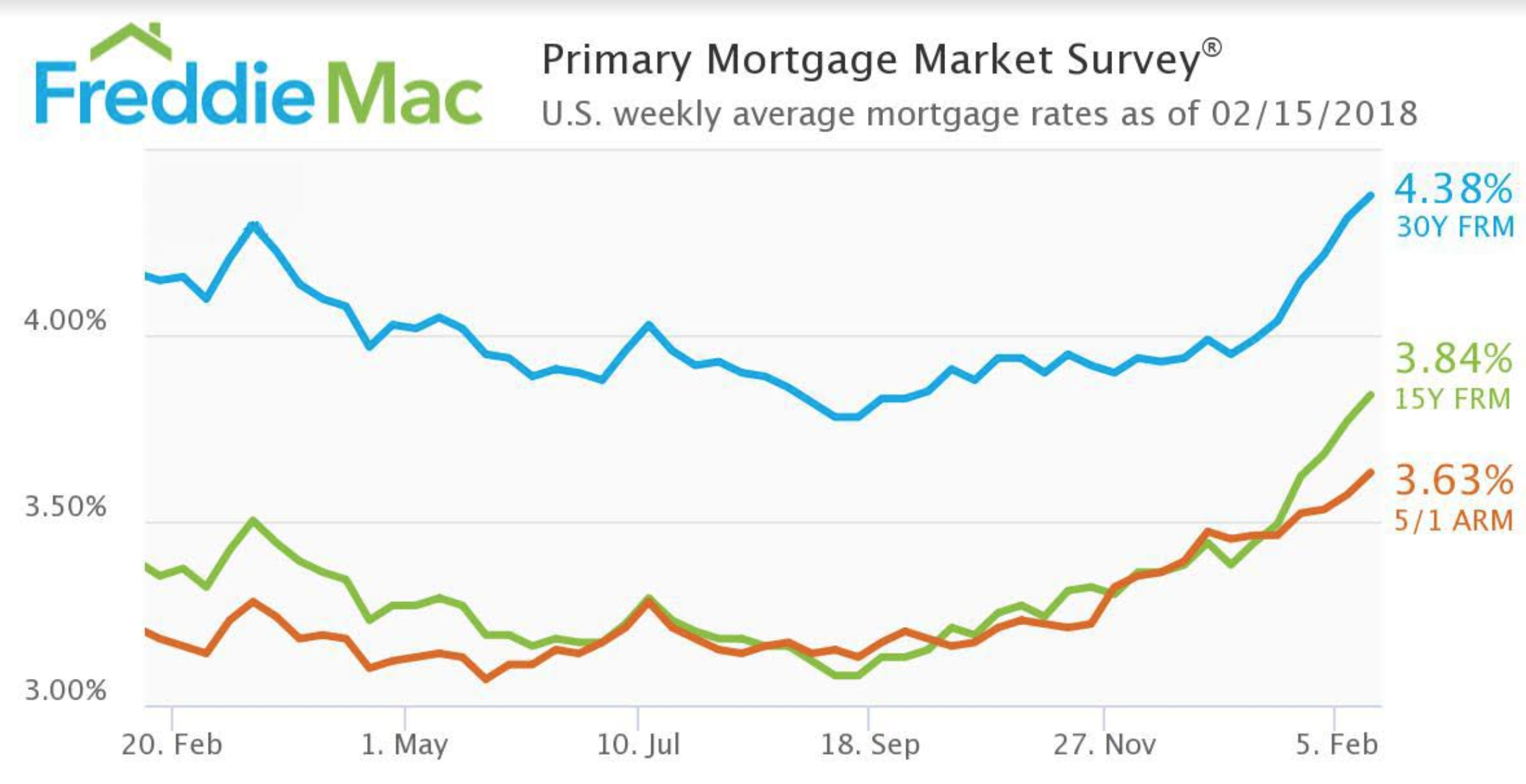

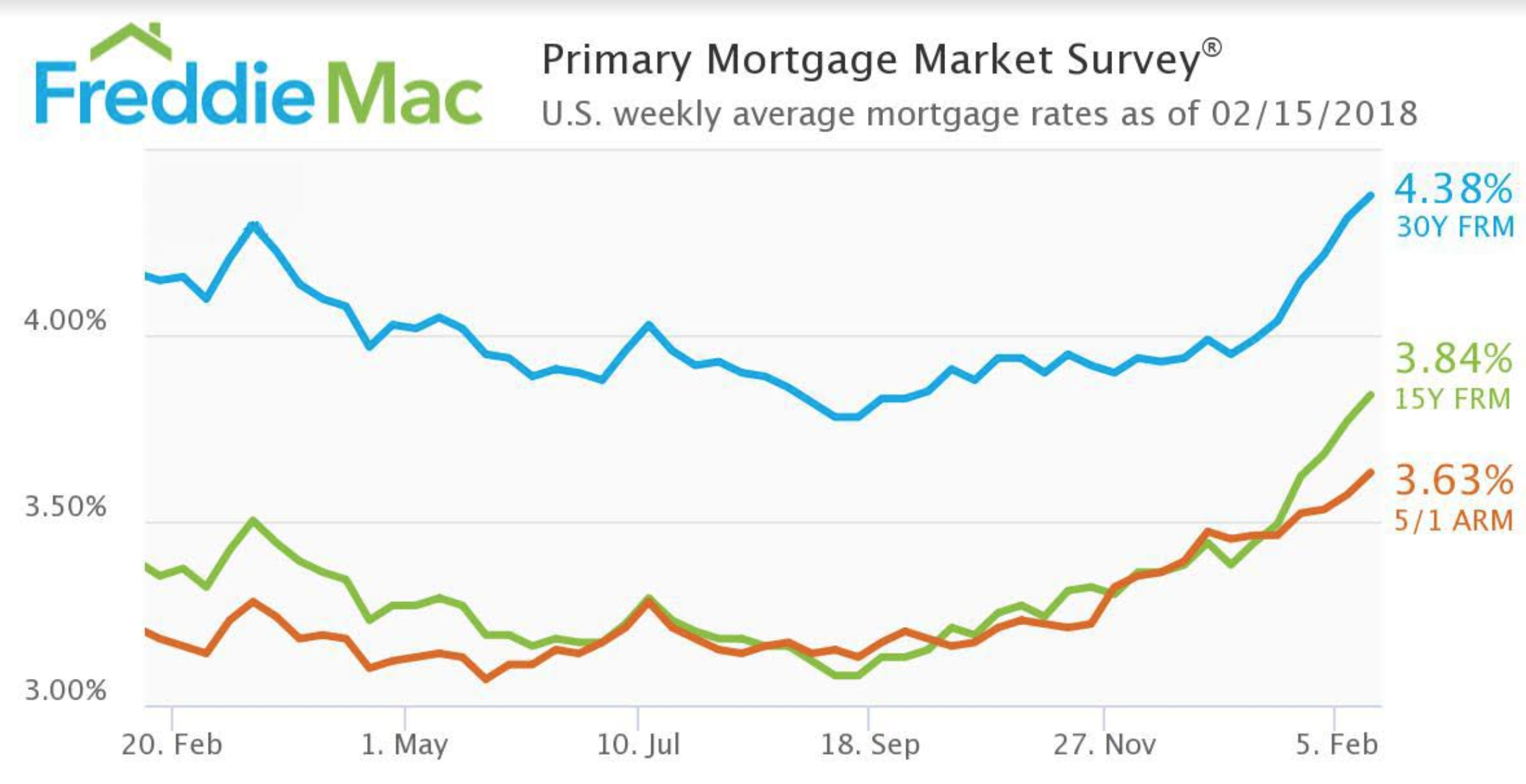

How the Mortgage Interest Tax Deduction is Changing in 2018

However, if you use the standard meal and snack rates in any tax year, you can use actual costs to compute the deductible cost of food in any other tax year. He multiplies his depreciable basis of $9,200 by 1.605% (0.01605), the percentage from the table for the fifth month. To figure the depreciation deduction, you must first figure the part of the cost of your home that can be depreciated . The depreciable basis is figured by multiplying the percentage of your home used for business by the smaller of the following. If you own your home and qualify to deduct expenses for its business use, you can claim a deduction for depreciation.

The business portion of your home mortgage interest allowed as a deduction this year will be included in the business use of the home deduction you report on Schedule C , line 30, or Schedule F , line 32. The simplified method is an alternative to the calculation, allocation, and substantiation of actual expenses. In most cases, you will figure your deduction by multiplying $5, the prescribed rate, by the area of your home used for a qualified business use. The area you use to figure your deduction is limited to 300 square feet. See Simplified Amount, later, for information about figuring the amount of the deduction. You meet the requirements for deducting expenses for the business use of your home.

No comments:

Post a Comment