Table of Content

- The Home Mortgage Interest Deduction and the Tax Treatment of Housing

- What is the mortgage interest deduction?

- Simplified Method Worksheet

- Permanent Build Back Better Act Would Likely Require Large Tax Increases on the Middle Class

- Three Possible Impacts of the TCJA Related to the Financial Services Sector

As the principal place of business for one or more of your trades or businesses. You occasionally conduct minimal administrative or management activities at a fixed location outside your home. The amount of time spent at each place where you conduct business. With the exception of these two uses, any portion of the home used for business purposes must meet the exclusive use test. You use the part of your home in question as a daycare facility .

Divide the area used for business by the total area of your home. The fair market value of your home is the price at which the property would change hands between a buyer and a seller, neither having to buy or sell, and both having reasonable knowledge of all necessary facts. Sales of similar property, on or about the date you begin using your home for business, may be helpful in determining the property's fair market value.

The Home Mortgage Interest Deduction and the Tax Treatment of Housing

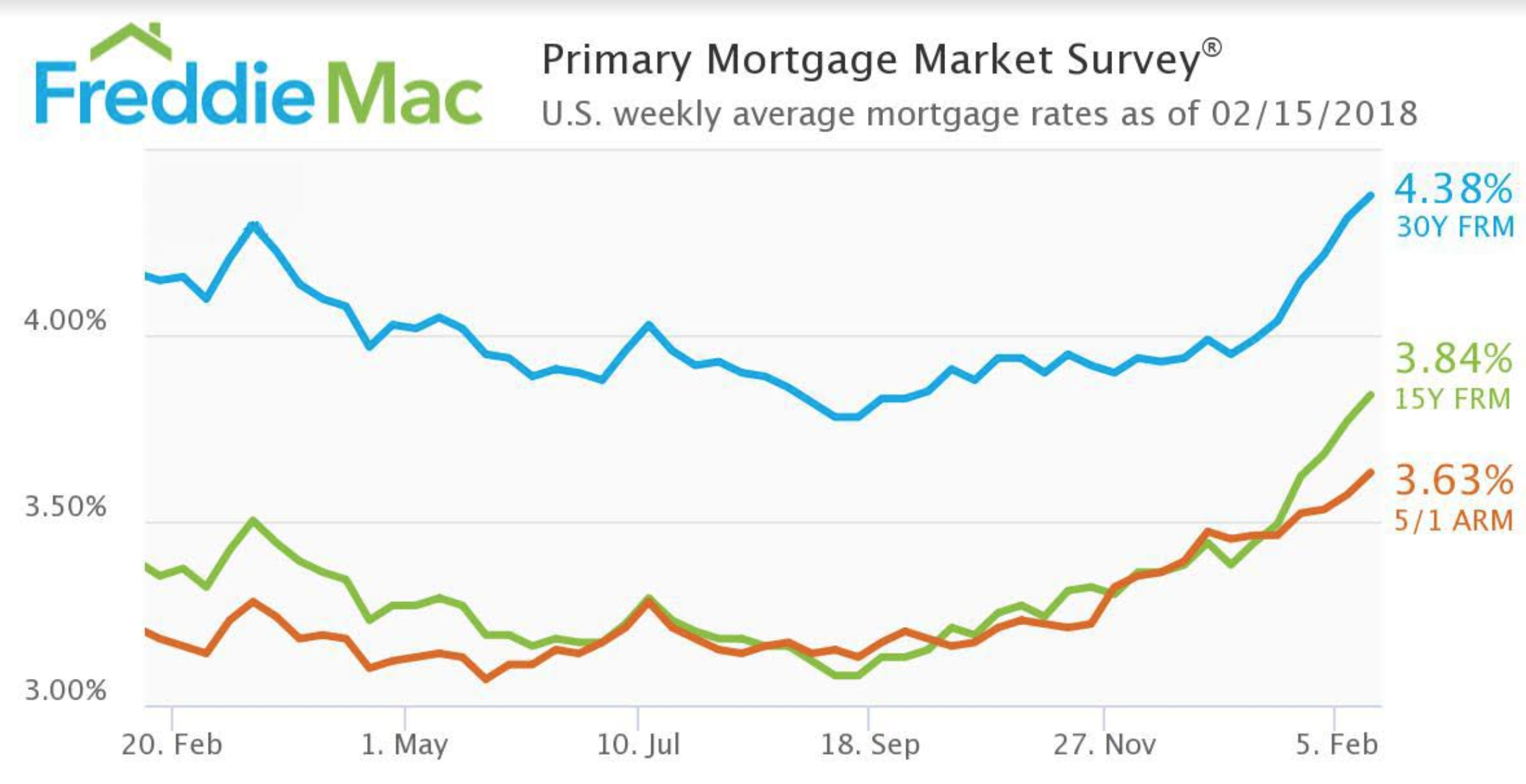

Amid all the open houses, some buyers and sellers may also be considering the tax implications of homeownership—specifically, the fate of the home mortgage interest deduction. The deduction cap also depends on how you file your returns. If you’re married and file jointly, you can deduct interest on $750,000 or $1 million, based on when you bought your home. If you file your returns separately, you can only deduct half of that—$375,000 or $500,000, respectively. If this mortgage interest stuff does matter to you, here are some examples of how the new TCJA mortgage interest deduction limits work. In this column, I’ll cover how the new law limits itemized deductions for mortgage interest.

The separate Form 4684 you attach to your return is used to figure the casualty losses you can include on line 15 of Schedule A and the net qualified disaster losses you can include on line 16 of Schedule A. This includes records of when and how you acquired your home, your original purchase price, any improvements to your home, and any depreciation you are allowed because you maintained an office in your home. You can keep copies of Forms 8829 or the Worksheet To Figure the Deduction for Business Use of Your Home, found later in this publication, as records of depreciation.

What is the mortgage interest deduction?

You must figure the deduction for any other home using actual expenses. If your business expenses related to the home are greater than the current year's limit, you can carry over the excess to the next year in which you use actual expenses. They are subject to the deduction limit for that year, whether or not you live in the same home during that year.

However, it does not include any part of your property used exclusively as a hotel, motel, inn, or similar establishment. Where To DeductSelf-Employed PersonsExpenses Deductible Without Regard to a Business Connection Using actual expenses to figure the deduction. The home mortgage interest deduction, which allows you to deduct the interest you pay on your mortgage from your taxable income, can add up to significant savings at tax time. It’s just one of the perks of homeownership, but it doesn’t apply to everyone with a mortgage — and the savings offered won’t always be significant. We’ll cover everything you need to know about who qualifies and how to calculate how much you can save. For rental property, the mortgage interest deductions has no loan limit amounts.

Simplified Method Worksheet

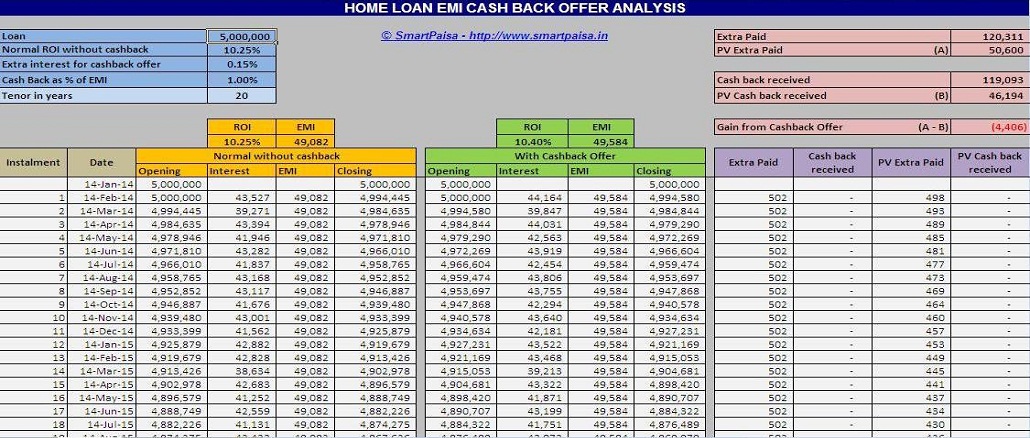

Table 1 can help you figure your qualified loan limit and your deductible home mortgage interest. The Worksheet To Figure the Deduction for Business Use of Your Home is to be used by taxpayers filing Schedule F or by partners with certain unreimbursed ordinary and necessary expenses if using actual expenses to figure the deduction. The following instructions explain how to complete each part of the worksheet. Use this worksheet if you file Schedule F or you are a partner, and you are using actual expenses to figure your deduction for business use of the home. Use a separate worksheet for each qualified business use of your home. If you itemize your deductions on Schedule A , only include the personal part of your real estate taxes on Schedule A , line 5b.

Prior versions of the bill proposed the elimination of the deducibility of mortgage interest on second homes but this provision was removed in the final passage of the bill. In other words, if you pay $10,000 in mortgage interest during 2018 and also pay $2,000 in mortgage insurance premiums, you will have $12,000 in deductible mortgage interest for the tax year. ▶ Tips and links to help you determine if you qualify for tax credits and deductions.

To know whether you meet that requirement, count your days of use and rental of the home only during the time you have a right to use it or to receive any benefits from the rental of it. You can choose to treat any debt secured by your qualified home as not secured by the home. This treatment begins with the tax year for which you make the choice and continues for all later tax years. You can revoke your choice only with the consent of the IRS.

Fill out only one Table 1 for both your main and second home regardless of how many mortgages you have. If you can take a deduction for points that weren’t reported to you on Form 1098, deduct those points on Schedule A , line 8c. A mortgage may end early due to a prepayment, refinancing, foreclosure, or similar event.

Only $100,000 of home equity indebtedness may be used in determining the allowable interest deduction ($50,000 if married filing separately). When completing line 2 of this worksheet for the Worksheet To Figure the Deduction for Business Use of Your Home, enter your adjusted gross income excluding the gross income and deductions attributable to the business use of the home. Do not use this worksheet to figure the amount to enter on line 8d of Schedule A. Enter any other business expenses that are not attributable to business use of the home on line 11.

She received monthly statements showing her average balance for each month. She can figure her average balance for the year by adding her monthly average balances and dividing the total by 12. For each mortgage, figure your average balance by adding your monthly closing or average balances and dividing that total by the number of months the home secured by that mortgage was a qualified home during the year. If you receive monthly statements showing the closing balance or the average balance for the month, you can use either to figure your average balance for the year. You can treat the balance as zero for any month the mortgage wasn't secured by your qualified home.

No comments:

Post a Comment